Cécile Civiale Vuiller

A typical professional trust company usually manages trusts for many individuals or families. However, very exigent clients wish to have a trustee that looks after them and their assets exclusively. In other words, a trustee that offers professional level of services and has no other clients than them.

It is possible to realise this desire by constituting a so-called Private Trust Company (“PTC”). This is an increasingly popular structure as it offers many advantages.

It is suitable for families with substantial business or private assets. These families need a tailor- made instrument that can evolve with the family over the long term, adapting to changes in generation, country or entrepreneurial activity.

A PTC solves the issues of estate planning, family governance and supervision of a large family business with a single instrument.

Advantages

PTCs offer many advantages to families in relation to the management of trusts:

- Family control: PTCs provide a means by which the client, or their family, can retain a greater degree of control over the trust affairs without compromising the validity of the family trusts;

- The use of a PTC ensures continuity of trusteeship. In contrast, ordinary corporate fiduciaries can undergo mergers, changes in ownership or even go out of business;

- Clear and individualised processes for wealth management and family governance.

- An appropriate limitation of liability for family members and professionals involved in the management of the trust.

- Improved investment opportunities: a PTC structure can facilitate the creation of investment vehicles, such as common trust funds;

- No limitation or constraints regarding the types of possible investment or assets (e.g. yacht, private jet, art collection, etc.);

- Family leadership opportunities: a PTC offers opportunities for family members to be involved in the management of the family’s assets or business;

- Training the new generation: processes can be defined within the PTC to train the new generation and enable them to become increasingly involved in the administration of the estate or the family business.

- Confidentiality: the ownership of the structure can remain confidential, typically if it is structured with the use of a purpose trust. This makes it easier to control access to and disclosure of, confidential information.

Management

As any corporation, a PTC is primarily managed by its board of directors. The composition of the board is a of paramount importance. In practice, it is the board that takes the trustee’s decisions, both in matters of management of the assets and of distributions. The board often consists of a mix of family members and professionals.

The settlor will typically request for some of his family members (beneficiaries of the trust or not) to sit on the board to ensure that his or her vision is understood and taken into account, as well as the family's background and dynamics. However, a settlor or family members willing to be appointed to the board of the PTC must understand that acting as a director is a time consuming and demanding position which can potentially lead to personal liability in extreme situations.

In principle, however, a professional trustee is always involved in the administration of the PTC. This ensures that decisions are taken impartially and in the long- term interests of the family. Moreover, managing a large and complex wealth is a profession in itself, requiring specific skills and training.

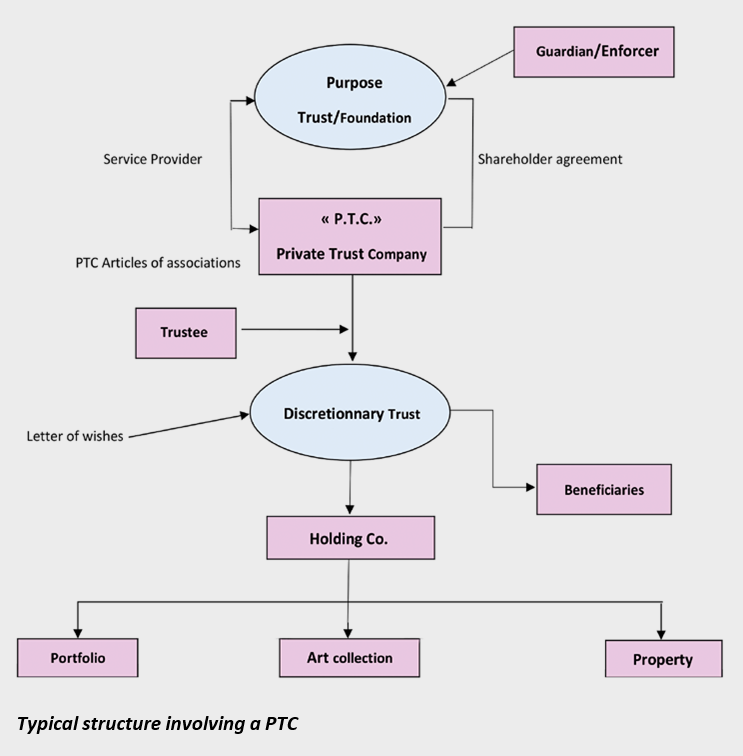

Ownership

In order to protect the PTC from any issues concerning its shareholders (death, insolvency, change of ownership in case of a corporate shareholder, etc.), the preferred solution is usually for the PTC to be ‘ownerless’. This can be achieved by setting up a non-charitable purpose trust or foundation with the sole purpose of holding the shares in the PTC. The purpose trust does not have beneficiaries, which avoids any succession issues. This vehicle can hold the shares of the PTC for an unlimited duration where that is required (for example, in the case of a "dynastic" structure being put in place for a HNW family). A private purpose trust must have an enforcer, whose role is to ensure that the purpose of the trust is effectively pursued. The enforcer must be independent from the trustee of the purpose trust. A professional adviser of the family is often considered appropriate for this role.

Retention of control

The settlor of a trust often wishes to retain some control over the assets he places in the trust. This is one of the reasons why people set up PTCs. However, it is very important that the trustee exercises its powers properly and independently.

The retention of significant control by the settlor and the absence of a real and effective transfer of governance over the trust assets can leave the trust particularly vulnerable to challenges on the grounds that the trust is a sham.

From a tax perspective, the trust may not be effective in certain jurisdictions unless the settlor is removed from the "sphere of influence” of the trust.

Taking into account the above remarks, and more generally in the interests of good governance, even though it is licit for the settlor or family members to be both beneficiaries and directors of the PTC, they should remain a minority on the board.

PTCs in Switzerland

The trust industry in Switzerland is highly developed and many PTCs have their headquarters in Switzerland. The political and economic stability of the country and the importance of its financial centre have a lot to do with this. The absence of taxation of trusts managed from Switzerland for families based abroad also increases the attractiveness of Swiss based trustees, as well as the absence of Swiss register of UBO’s. Last but not least, Switzerland is one of the most trusted countries across the globe. The Edelman Trust Barometer found companies headquartered in Switzerland are the second most trusted after Canada.

XLNC MAGAZINE | No. 10 | Autumn 2022