Werner Schulze

Balance Sheet, Statement of Comprehensive Income, Cash Flow Statement and Enterprise Valuation

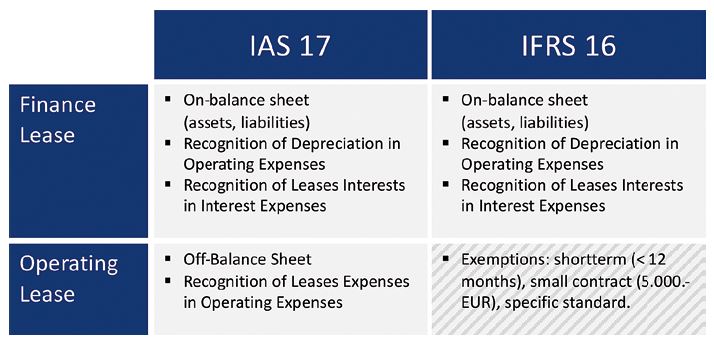

Since 01 January 2019, the new accounting standard for lease accounting (IFRS 16) is mandatory and replaces IAS 17, with the result that almost all leases — also qualified in the past as operating leases — now must be recognised in the balance sheet.

This can have a significant impact on metrics such as equity ratio, debt-to-equity ratio, EBITDA, operating cash flow, etc. These key figures, in turn, are used in investor and analyst assessments, ratings and rating assessments or are the basis for determining covenants in loan agreements or other agreements.

Impact on the balance sheet

When the leases are concluded, the rights of use of the respective assets are to be recognised on the assets side of the balance sheet and, on the liabilities side, the lease liabilities from the payment obligations. The consequence is a generally not insignificant balance sheet extension with a corresponding impact on the equity ratio (deterioration/reduction) and debt-to-equity ratio (deterioration/increase).

Effects on the statement of comprehensive income

In the income statement, lease expenses (previously generally recognised under other operating expenses) are divided into depreciation and interest expense, with the result that EBIT (a common measure of operating income) improves by interest expense. The impact on EBITDA is even more pronounced, since depreciation is also eliminated here and therefore EBITDA improves by the total leasing expenses.

Effects on the cash-flow statement

To the same degree that EBITDA improves as a result of total leasing expenses, the operating cash flow is also relieved or improved and is being relocated to interest expense and repayments in cash flow from financing activities. There is no impact on total cash flow — only shifts between activity areas.

Impact on business valuation

In general, the value of a business should not change as a result of an amendment or change of an accounting standard — especially if the total cash flow remains unchanged. However, a company valuation is based on models with numerous parameters, which also differ according to the valuation method(s). In addition, a distinction must be made between procedures that directly assess equity and procedures that value the entire enterprise and, by deduction of the debt, compute the value of equity.

Part of these parameters, e.g. the beta (ß) or multipliers, are derived from past data of comparable companies/transactions. Now, however, parameters derived from the past (prior to application of IFRS 16) cannot be readily reconciled/applied to figures using IFRS 16.

DCF (Discounted Cash Flow) method

The following parameters, which are changed by the introduction of IFRS 16, are amongst other factors included in a DCF valuation:

- Free cash flow: a resulting increase raises the overall value of the company.

- WACC (weighted average cost of capital): due to an increase in leverage tends to reduce the WACC and thus increase the overall value of the company.

- Debt ratio: increases the indebted ß and thus has a reducing effect on the overall value of the company.

- Financial liabilities: increase has a negative effect on the value of equity in the reconciliation of the total enterprise value to the equity value.

Multiples method

The following parameters, which are changed by the introduction of IFRS 16, are amongst other factors included in a multiplier rating (e.g., by means of EBITDA multipliers):

- EBITDA: increase has an increasing effect on the total enterprise value.

- Financial liabilities: increase has a negative effect on the value of equity in the reconciliation of the total enterprise value to the equity value.

Specifically, in the transitional period from IAS 17 to IFRS 16, there should be an increased potential for irritation regarding the interpretation of key figures. In our opinion, it is recommended that these irritations be counteracted by increased transparency and explanations.

XLNC MAGAZINE | No. 03 | May 2019